How does Benson MIC work

PURCHASING SHARES

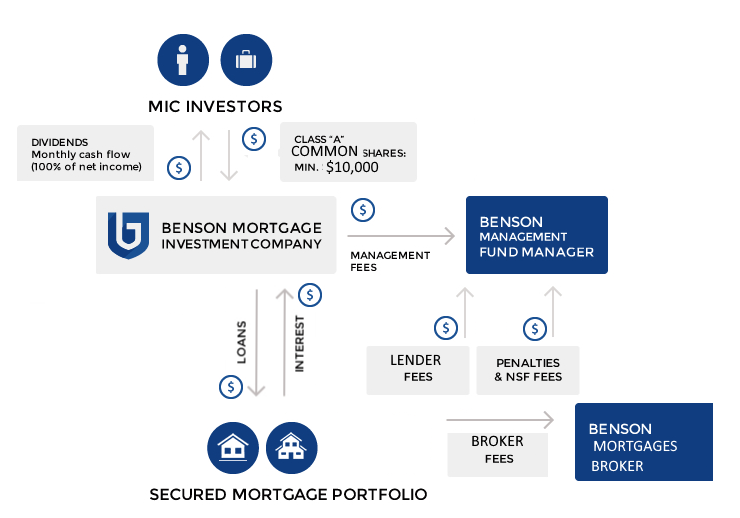

The process starts when an Investor first deposits funds into the MIC. These funds are then exchanged for shares of the company. Each investor is entitled to an appropriate number of common shares, which entitles the shareholder to his/her pro rata share of mortgage income earned by the MIC.

Shares are valued at $10 and the minimum initial investment is $10,000. Once the initial investment has been made, additional deposits can be made as low as $5,000.

When investing within an RRSP or TFSA instead of cash the investor instructs his/her trustee to deposit funds on his/her behalf into the MIC. The trustee receives the common share certificate and holds the certificate “in trust” on behalf of the shareholder.

Please ask us for more information.

PORTFOLIO SELECTION AND ADMINISTRATION

Once an investor’s funds have been deposited into the MIC, the management team at Benson Mortgage Investment Corporation selects mortgages to fund with the new investment. Day-to-day administration of the portfolio includes: receipt and posting of mortgage payments, funding new mortgages, renewal of existing mortgage loans, property insurance and tax follow up, maintaining amortization schedules and bank records for the portfolio.

BENSON MORTGAGE INVESTMENT CORP. also maintains an appropriate amount of cash within the portfolio so that existing investors can potentially make redemptions of their principal amount during the year. The amount of cash on hand varies throughout the year and thus redemptions are subject to a minimum of 3 months notice, and might not be possible due to tax regulations, depending on the amount of the investment.

DIVIDENDS

According to section 130.1 of the Canadian Income Tax Act, a MIC must distribute 100% of its annual net income before taxes to shareholders in the form of a dividend. Dividend payments to investors are made on a regular basis; Benson MIC currently pays a monthly 8,5% – yearly rate (payable quarterly) distribution and once the audited financial statements are completed, any surplus is required to be paid within 90 days of the year-end (December 31).

CORPORATE AUDIT

At the end of every fiscal year, the MIC is audited by an independent accounting firm. The results of this audit are made available to every investor in the form of audited financial statements.

Benson MIC mortgages are administered by Benson Management Corporation.

Administrator Licence #12350

GET STARTED

Get in touch with us on 416 477 5500 or write to us on our Contact Page